|

|||

|

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

Exploring the Best Home Equity Loans in Texas: A Comprehensive GuideFor many homeowners in the Lone Star State, tapping into the value of their home through a home equity loan is an attractive financial option. But what exactly makes a home equity loan the best choice for Texans? With the state’s unique legal framework and diverse economic landscape, selecting the right loan can be both an art and a science. Let’s delve into the nuances of home equity loans in Texas, considering factors that include interest rates, lender reputations, and the regulatory environment, to help you make a well-informed decision. Understanding Home Equity Loans A home equity loan allows you to borrow against the value of your home, essentially using your property as collateral. This type of loan can be an excellent way to finance large expenses, such as home renovations, education, or debt consolidation. In Texas, the process is slightly different compared to other states due to specific laws designed to protect homeowners.

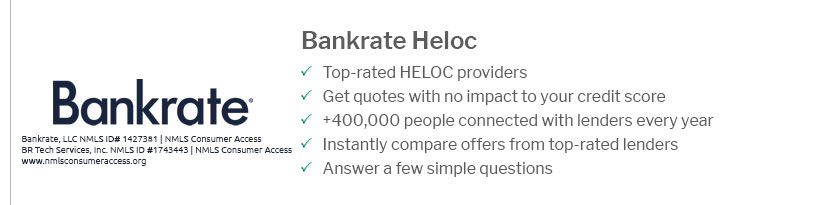

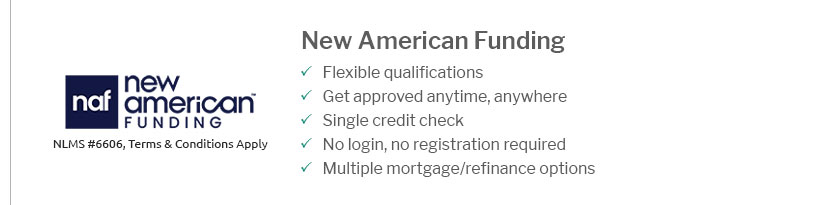

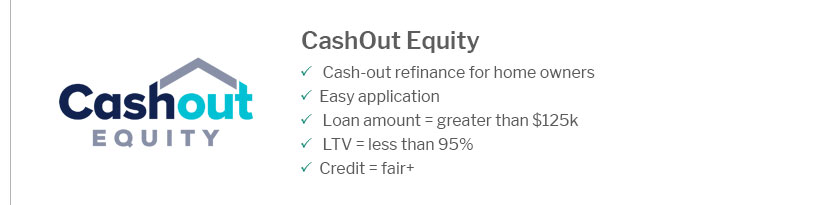

Choosing the Right Lender The first step in finding the best home equity loan is identifying the right lender. Reputation is key; look for lenders with strong customer reviews and a track record of transparency. Local institutions often offer competitive rates and personalized service, which can be advantageous for homeowners who value a more tailored approach. Moreover, comparing fees and closing costs is essential. Some lenders might offer lower interest rates but compensate with higher fees. Be sure to evaluate the total cost of the loan, not just the interest rate, to avoid any surprises. The Application Process Applying for a home equity loan in Texas involves several steps, starting with a thorough evaluation of your financial situation. Lenders will assess your credit score, income, and the amount of equity you have in your home. It’s wise to gather all necessary documentation in advance to expedite the process. Once approved, you’ll receive a lump sum, which you can use as you see fit. Subtle Opinions and Insights While it might seem daunting, navigating the home equity loan landscape in Texas can be rewarding with the right approach. The stability of a fixed rate combined with the security of borrowing against your own asset makes these loans a compelling option for many. However, caution is advised-over-leveraging can lead to financial strain, especially if property values fluctuate. Therefore, it’s prudent to borrow only what is necessary and maintain a cushion for unforeseen circumstances. Conclusion In conclusion, finding the best home equity loan in Texas requires careful consideration of various factors, from interest rates and lender reputations to the unique legal stipulations of the state. By thoroughly researching and comparing different options, Texans can unlock the potential of their home’s equity while safeguarding their financial future. The key lies in balancing ambition with prudence, ensuring that the loan serves as a tool for growth rather than a burden. As you embark on this journey, remember that the best choice is one that aligns with your long-term financial goals and personal circumstances. https://money.com/best-home-equity-loans/

Flagstar (NMLS #417490) offers lines of credit of up to $1 million, which makes it the best HELOC option for large loans. Flagstar's home equity ... https://www.frostbank.com/personal/banking/loan-products/equity

Frost Home Equity Loan Details ; $2,000 - $49,999 / 10 years, 7% ; $2,000 - $49,999 / 15 years, 7.28% ; $2,000 - $49,999 / 20 years, 7.59% ; $50,000 or greater/7 ... https://www.rbfcu.org/home-loans-realty/home-equity-loans

If you have property in Texas, a home equity loan or home equity line of credit (HELOC) can be an economical way to obtain a low-rate loan.

|

|---|